What exactly is a credit score? And how do I find mine?

If you got your first credit card in the U.S. and started building your credit history, now you need to start learning how to manage it. You might have heard of the term “credit score” from time to time, and it’s absolutely an important element within your credit history. But what does it mean and how can you check it? Keep reading to learn more!

What’s a credit score?

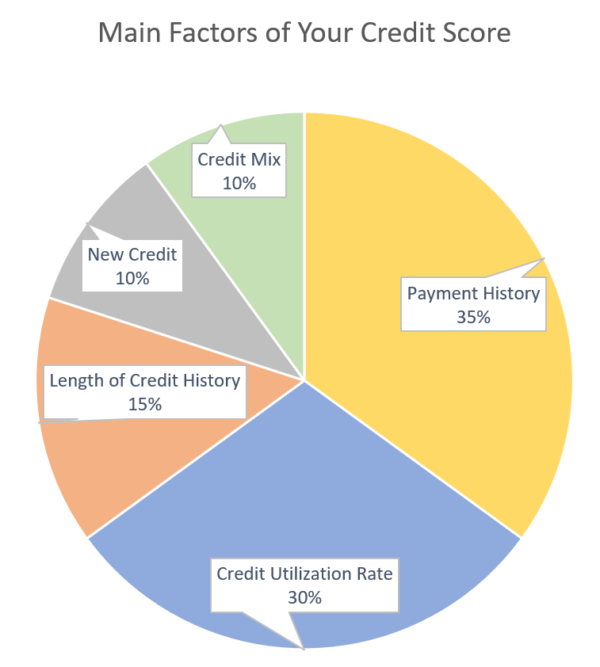

Generally, a credit score is a three-digit number that indicates how likely you are to pay back loans. Bankers and lenders, or sometimes even employers, use it to decide whether it’s worth approving you for a credit card or loan, or having you work for them. Therefore, a credit score represents the creditworthiness of an individual. But what decides the actual credit score? There are five main factors that might affect your credit score, fortunately, not all factors are taken equally. One of the main elements is your payment history. See the chart to clarify the five main components that affect your credit score.

What does a ”good” credit score mean? Is it important?

Having a good credit score can best demonstrate that you’re a responsible person who has continuously stayed on top of financial obligations.Lenders are more likely to loan you money if you have a good credit score because they consider you to be a good investment. Therefore, it’s important to take good care of your credit history. Following are the main factors that you need to be aware of:

1. Make payments on time:

Stay up to date with your payments. If you miss one payment accidentally, try to pay it as soon as possible. Delinquent payments can have a major negative impact on your credit score. Moreover, paying the full balance can avoid paying interest as well.

2. Keep balances low on credit cards:

Don’t use up all the available credit on your credit card. High usage can have a negative impact on your credit score. Therefore, keeping your balance low can benefit your score.

“To keep credit score strong, aim for using less than half of your available credit lines,” says Sarah Davies, senior vice president for VantageScore Solutions.

3. Do not close unused credit cards:

Even if you’re not using a certain credit card that often, you shouldn’t close the account because the longer your credit history, the better.

4. Manage multiple credit cards responsibly:

It’s okay to have several credit cards, as long as you make every payment on time, every time.

If you’d like to dig deeper into what exactly each component means, you can see official explanations on the FICO Score website.

So how can I check my credit score?

1. Check your credit card, financial institution, or loan statement:

If you already have a credit card, you can see if the company provides a credit score as part of your account information. You can look up the credit score online by logging into your account. You can also check with your lenders, like banks, to determine whether you have access to see your credit report.

2. Monitor credit scores directly from one of the three major credit bureaus:

Equifax, Experian, and TransUnion are the three major credit bureaus in the U.S. They provide a free copy of your credit report once a year, though you might need to pay in order to keep tracking your credit report more often.

3. Use a credit score service or free credit scoring website:

Some websites provide free credit scores for users to keep track of their credit history. For instance, freecreditreport (part of Experian) and creditkarma provide access to free credit scores.

Be responsible for your credit history and credit score

It’s important to review your credit report carefully and to be aware of your credit score from time to time. If you find inaccurate information on your report, you need to take action immediately to request a dispute from the agency. A good credit report and credit score can help you access the best interest rates and help you secure loans more easily. Last but not least, keeping track of your credit score is a great way to make sure your credit score is in good shape and to stay in control of your finances.